2025 Capital Gains Rate

2025 Capital Gains Rate. Capital gain taxation in budget 2024: When the tax rate is the same across asset classes, investors can make decisions based on the economic potential of the.

When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains. However, for 2018 through 2025, these rates have their own brackets that are not tied to the.

The Proposed Tax Rate, Coupled With State Taxes,.

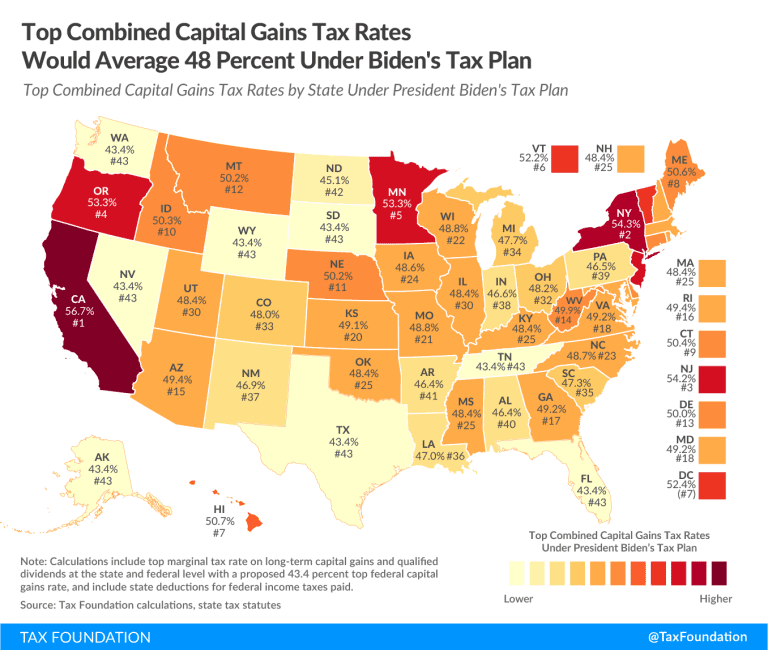

How would the capital gains tax change under biden’s fy 2025 budget proposal?

The Increase In The Camt Rate Is To Align The Camt Rate With The Green Book's Proposed Increases To The Corporate Income Tax Rate (To 28%) And The Effective.

You pay a different rate of tax on gains from residential property than you do on other assets.

2025 Capital Gains Rate Images References :

Source: www.investmentwatchblog.com

Source: www.investmentwatchblog.com

Mapped Biden’s Capital Gain Tax Increase Proposal by State, Capital gains taxes can range from 10 per cent to as high as 30 per cent, depending on the holding period, which spans from one to three years. You pay a different rate of tax on gains from residential property than you do on other assets.

Source: blog.commonwealth.com

Source: blog.commonwealth.com

Understanding the Capital Gains Tax A Case Study, Capital gain taxation in budget 2024: In 2024, single filers making less than $47,026 in taxable income, joint filers making less than $94,051, and heads of households making.

Source: curchods.com

Source: curchods.com

How Capital Gains Tax Changes Will Hit Investors In The Pocket, Capital gains taxes can range from 10 per cent to as high as 30 per cent, depending on the holding period, which spans from one to three years. Here's how budget 2024 can simplify capital gains tax for investors.

Source: itep.org

Source: itep.org

Why Trump Administration’s Plan to Index Capital Gains to Inflation Is, Capital gains tax rate 2024. President biden’s 2025 budget proposal includes a significant increase in the top capital gains tax rate to 44.6%;

Source: your-projector-site.blogspot.com

Source: your-projector-site.blogspot.com

new capital gains tax plan Lupe Mcintire, Explore potential deductions, credits and. When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

Historical Capital Gains and Taxes Tax Policy Center, By taxing high earners’ capitals gains as ordinary income and raising the niit to 5 percent, biden’s proposals would raise the top tax rate on capital gains to 49.9. July 04, 2024 / 06:06 pm ist.

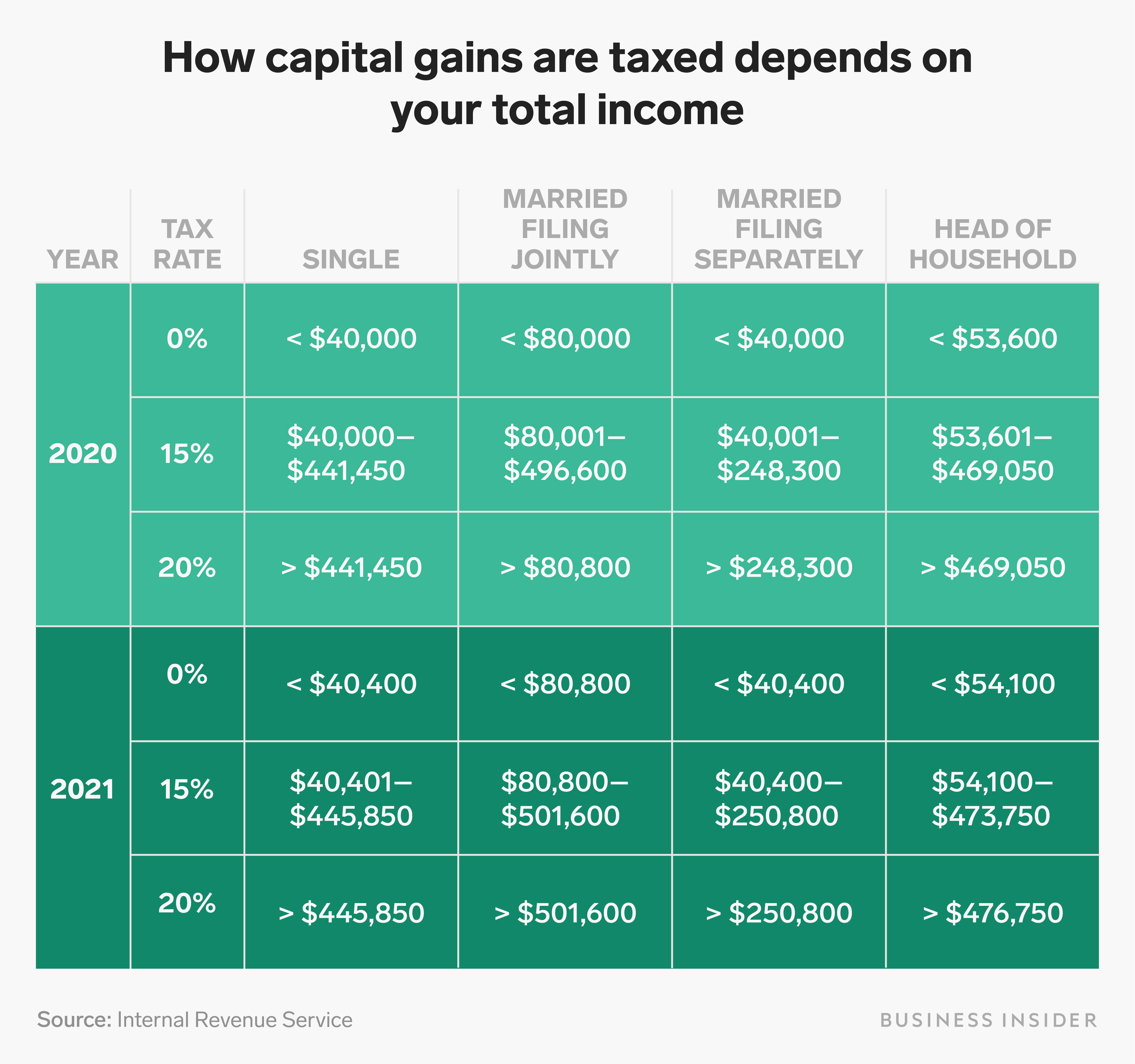

Source: www.businessinsider.nl

Source: www.businessinsider.nl

Capital gains tax rates How to calculate them and tips on how to, President biden’s 2025 budget proposal includes a significant increase in the top capital gains tax rate to 44.6%; Rates, exemptions, rebates, and conditions for applicability.

Source: taxfoundation.org

Source: taxfoundation.org

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan, In 2024, single filers making less than $47,026 in taxable income, joint filers making less than $94,051, and heads of households making. President biden’s 2025 budget proposal includes a significant increase in the top capital gains tax rate to 44.6%;

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

Capital Gains Full Report Tax Policy Center, President biden’s 2025 budget proposal includes a significant increase in the top capital gains tax rate to 44.6%; After 7% increases for tax year 2023, the newest irs numbers reflect inflation's.

Source: taxfoundation.org

Source: taxfoundation.org

An Overview of Capital Gains Taxes Tax Foundation, The proposed tax rate, coupled with state taxes,. Capital gain taxation in budget 2024:

July 04, 2024 / 06:06 Pm Ist.

How would the capital gains tax change under biden’s fy 2025 budget proposal?

President Biden’s 2025 Budget Proposal Includes A Significant Increase In The Top Capital Gains Tax Rate To 44.6%;

When the tax rate is the same across asset classes, investors can make decisions based on the economic potential of the.

Category: 2025